Please note that this page is automatically translated.

ガバナンスの構築

Strengthening Governance Structure

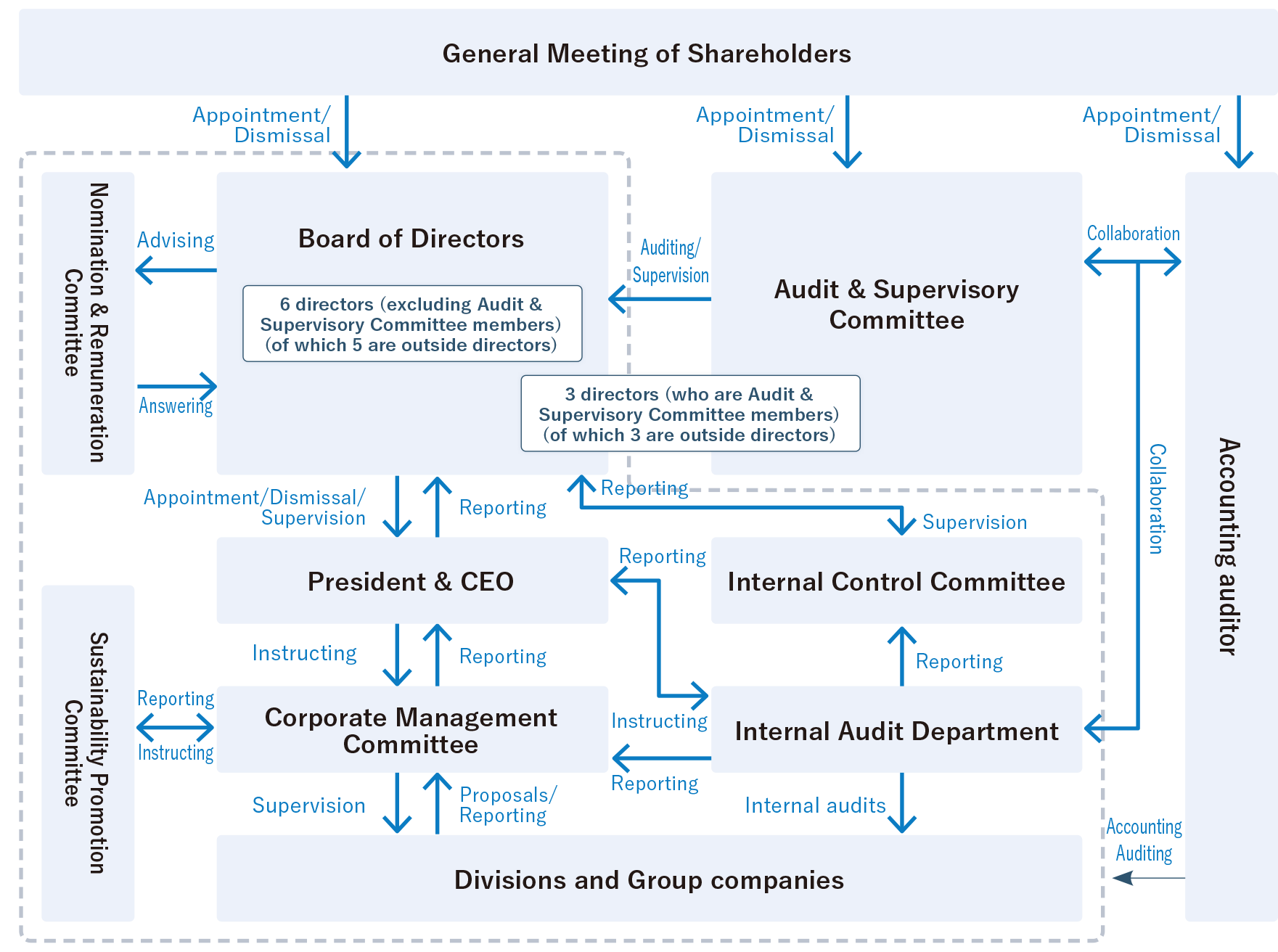

We are working to strengthen governance by separating oversight and execution, and establishing a structure in which the Board of Directors is responsible for overseeing the Management Committee, Internal Control Committee, Sustainability Promotion Committee, etc.

Corporate Governance

Basic Concept

Our basic approach to corporate governance is to enable management to personally verify compliance with laws, regulations, the Articles of Incorporation, etc., and to ensure that this management system is sustainable. We also believe that establishing a system that directs the awareness and work of all officers and employees toward the realization of our management philosophy and business goals will lead to fair and transparent management, and contribute to the interests of stakeholders.

Corporate Governance Overview

We have adopted the structure of a company with an audit and supervisory committee and have established an audit and supervisory system. We aim to increase transparency and objectivity by increasing the composition and diversity of outside directors on the Board of Directors, further strengthening corporate governance, promoting the separation of business execution and supervision, and accelerating decision-making by delegating authority to the Representative Director, President and Executive Officers.

Board of Directors

The Board of Directors (8 directors, 6 of whom are outside directors; chaired by Representative Director Masahiro Yamamoto) is made up of personnel with experience, expertise, and ethical standards, and is mindful of diversity and a balance of knowledge, experience, and ability. The Board discusses management policies and medium- to long-term strategies, makes decisions on important matters, and oversees (monitors) business execution.

Nomination and Remuneration Committee

The Committee was established as a voluntary advisory body to the Board of Directors to enhance the fairness and transparency of procedures related to the nomination and remuneration of directors. It deliberates and reports on matters such as the appointment and dismissal of executives, including the President and Representative Director, and remuneration, as well as the formulation and implementation of succession plans, in response to consultations from the Board of Directors. To ensure independence, the majority of committee members are independent outside directors.

Audit and Supervisory Committee

The Audit and Supervisory Committee is made up of three directors (all of whom are outside directors). They monitor the directors’ execution of their duties by attending important meetings such as the Board of Directors and the Internal Control Committee, and by investigating important documents and receiving reports and hearings. We have established a system for immediately reporting to the Audit and Supervisory Committee members any violations or potential violations of laws, regulations, the Articles of Incorporation, or internal regulations, and by coordinating with the Internal Audit Department, we strive to prevent and detect fraudulent or improper conduct at an early stage.

Management Meeting

The Committee is made up of executive directors and executive officers, and supports the decision-making of the Representative Director and President, discusses matters to be resolved by the Board of Directors, and considers important management issues that have been delegated authority.

Sustainability Promotion Committee

Please check our sustainability management philosophy and promotion system.

◎Corporate Governance Structure

Dialogue with shareholders and capital policy

For details, please see page 3 “Principle 5-1: Dialogue with Shareholders” and “Principle 5-2: Formulation and Publication of Business Strategies and Business Plans” in the Corporate Governance Report.

Compliance

Management system

Based on our corporate philosophy, we are promoting thorough compliance by observing laws, social norms, the Code of Conduct for our Group, various policies, and internal regulations.

As for our management structure, we have established an Internal Control Committee, chaired by the Representative Director and President, and composed of external experts and other knowledgeable individuals. This Committee meets regularly to implement necessary cross-group improvement measures and awareness campaigns. It regularly reports the status of compliance to the Board of Directors annually and is subject to their supervision. We have systems in place to ensure that any serious facts, such as various violations, or the discovery of the potential for such facts, are immediately reported to the Audit and Supervisory Committee members and the Internal Control Committee.

Furthermore, all forms of corruption, including bribery, are prohibited under the Code of Conduct, and the Board of Directors oversees the establishment, revision, and operation of the Code of Conduct.

Code of Conduct

To realize a sustainable society and corporate growth, we comply with laws and regulations and aim to be a company that is widely trusted by stakeholders, including customers, business partners, employees and their families, local communities, shareholders and investors, and we have established and practiced a code of conduct.

Compliance training

To enhance awareness of compliance and instill an understanding of its importance, we provide training for employees. This training includes learning about the Group’s Code of Conduct, which stipulates the prevention of unfair competition and all forms of corruption, including bribery, as well as general compliance. In FY25, we conducted online training on compliance and responsibility toward consumers. Additionally, each operating company conducts training on relevant laws and regulations, such as the Act Against Unjustifiable Premiums and Misleading Representations (Premium Labeling Act), Copyright Law, and Whistleblower Protection Act, as well as information management (such as personal information) and harassment, during promotion training and other programs.

Whistleblowing system (hotline)

We have set up a reporting and consultation hotline to handle various compliance violations, including various forms of harassment and discrimination, human rights violations, violations of labor standards, environmental pollution, unfair competition, and all forms of corrupt practices, including bribery, in order to quickly identify and resolve problems. We also maintain confidentiality and ensure anonymity to prevent any disadvantage to whistleblowers.

When a report or consultation is received, the Compliance Office, together with legal and other experts, will request an investigation from the relevant department as necessary, and will respond based on the results (punishment, training, progress confirmation, etc.). We also make these hotlines known to employees through helpline cards and educational posters.

Risk Management

Management system

In order to identify and appropriately manage risks that threaten the sustainable growth of the company, we have established “Risk Management Regulations” and established an Internal Control Committee. The committee meets regularly to analyze and evaluate significant risks, formulate improvement measures, and report to the Board of Directors. In the event of an emergency, we have established a system that allows for a swift response based on the “Crisis Management Regulations.” In addition, the Internal Audit Office, which reports directly to the President, conducts regular audits, provides guidance and reports on improvements, and works with the Audit and Supervisory Committee and accounting auditors to reduce risks.

Risk Management Regulations

The Risk Management Regulations aim to protect corporate value by identifying a variety of risks in a unified manner, minimizing damage through prevention and rapid, accurate response, and preventing recurrence. The regulations stipulate compliance policies, risk definitions, management structures, the roles of the Internal Control Committee and department and office managers, and emergency response structures.

Business risks

We identify and disclose risks that may have an impact on our financial position, business performance, etc., and that could have a significant impact on investor decisions. Even if an item does not necessarily qualify as a risk factor, we will disclose it from the perspective of proactive information disclosure if it is considered to be important in investment decisions.

For details, please see “Business Risks” on page 20 of the Securities Report for the fiscal year ending September 2024.